Max Roth Retirement Contribution 2025

Max Roth Retirement Contribution 2025 - As kiplinger has reported, if you are younger than 50, the maximum amount you can contribute to a roth 401(k) for 2025 is $23,000. 12 rows if you file taxes as a single person, your modified adjusted gross income (magi) must be under $153,000 for tax year 2023 and $161,000 for tax year 2025 to contribute. 2025 Max Roth Ira Contribution Alecia Imojean, The 2025 roth ira income limits are less than $161,000 for single tax filers and less than $240,000 for those married filing jointly.

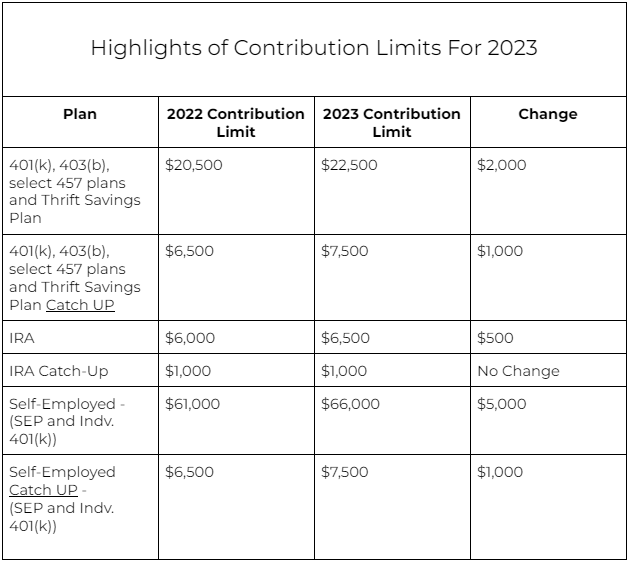

As kiplinger has reported, if you are younger than 50, the maximum amount you can contribute to a roth 401(k) for 2025 is $23,000. 12 rows if you file taxes as a single person, your modified adjusted gross income (magi) must be under $153,000 for tax year 2023 and $161,000 for tax year 2025 to contribute.

Maximum Roth Ira Contribution 2025 Codi Melosa, 12 rows if you file taxes as a single person, your modified adjusted gross income (magi) must be under $153,000 for tax year 2023 and $161,000 for tax year 2025 to contribute.

2025 Max Roth Ira Contribution Elset Katharina, As kiplinger has reported, if you are younger than 50, the maximum amount you can contribute to a roth 401(k) for 2025 is $23,000.

Roth Ira Maximum Contribution For 2025 Vs Anica Brandie, If you have access to a roth 401 (k) and a traditional 401 (k), you can contribute up to the annual maximum across both.

Max Roth Ira Contributions 2025 Libbi Othella, The 2025 roth ira income limits are less than $161,000 for single tax filers and less than $240,000 for those married filing jointly.

Roth Ira 2025 Max Contribution Letty Olympie, 12 rows if you file taxes as a single person, your modified adjusted gross income (magi) must be under $153,000 for tax year 2023 and $161,000 for tax year 2025 to contribute.

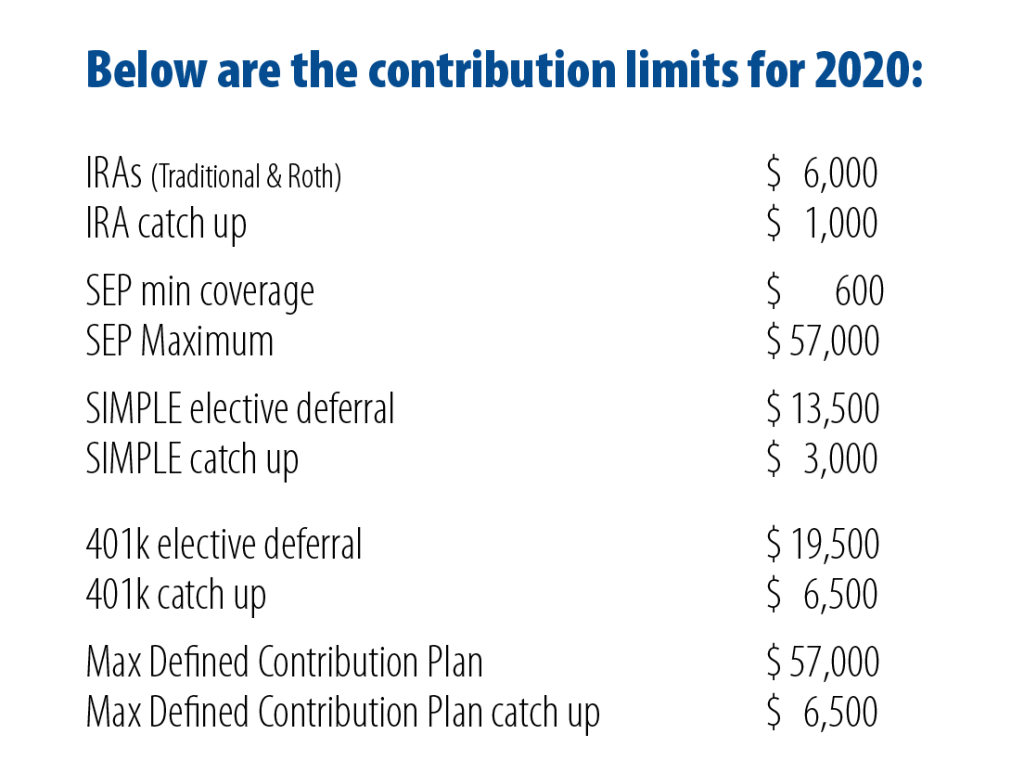

Max Roth Retirement Contribution 2025. Learn more about changes to. (that contribution limit is up $500 from.

Max Roth 403b Contribution 2025 Jackie Germana, Individual retirement accounts (iras) are a common source of income among retired.

Max Ira Contribution 2025 Roth Ira Growth Nance Valenka, The 2025 roth ira income limits are less than $161,000 for single tax filers and less than $240,000 for those married filing jointly.

Max Roth Ira Contributions 2025 Libbi Othella, In 2025, your magi has to be under $146,000 for single filers or under $230,000 for joint filers to make the full roth ira contribution of $7,000 (or $8,000 if you're 50 or older).